Some Known Factual Statements About Reverse Mortgage

Advertiser Disclosure At Geek Wallet, we aim to help you make financial decisions with self-confidence. To do this, numerous or all of the items included here are from our partners. Nevertheless, this doesn't influence our examinations. Our viewpoints are our own. After retirement, without regular income, you may often fight with financial resources.

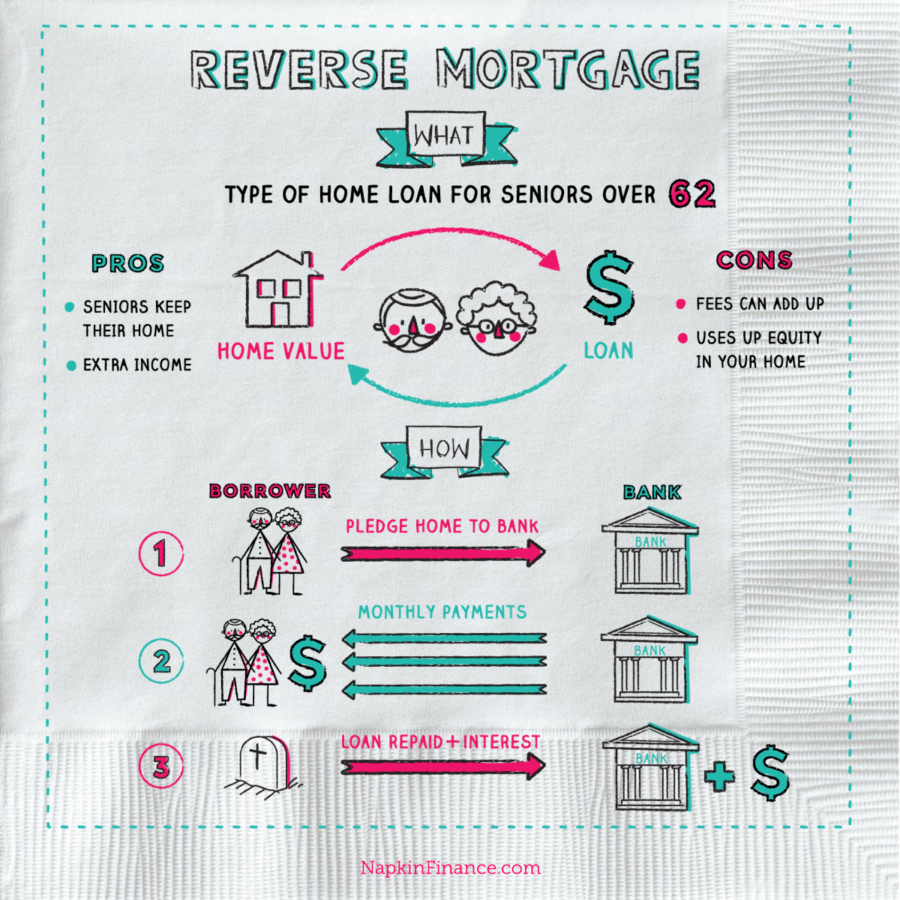

A reverse home mortgage is a mortgage that enables property owners 62 and older to withdraw some of their house equity and transform it into cash. You don't have to pay taxes on the earnings or make regular monthly mortgage payments. You can utilize reverse mortgage profits nevertheless you like. They're frequently earmarked for expenditures such as: Debt debt consolidation Living costs Home enhancements Helping children with college Buying another home that might better meet your requirements as you age A reverse mortgage is the opposite of a standard mortgage; instead of paying a lending institution a month-to-month payment Click to find out more each month, the lending institution pays you.

The amount you receive in a reverse home mortgage is based on a moving scale of life span. The older you are, the more home equity you can pull out." MORE: How to get a reverse home mortgage The Federal Housing Administration guarantees two reverse home loan types: adjustable-rate and a fixed-rate.

The Main Principles Of Reverse Mortgage

2. Adjustables have five payment choices: Tenure: Set regular monthly payments so long as you or your qualified partner remain in the home Term: Set monthly payments for a set duration Line of credit: Undefined payments when you require them, till you have actually exhausted your funds Modified tenure: A line of credit and set month-to-month payments for as long as you or your qualified spouse live in the house Customized term: A line of credit and set regular monthly payments for a fixed period of your picking To request a reverse mortgage, you need to fulfill the following FHA requirements: You're 62 or older You and/or a qualified partner-- who need to be named as such on the loan even if she or he is not a co-borrower-- reside in the home as your main house You have no overdue federal financial obligations You own your house outright or have a substantial quantity of equity in it You participate in the http://www.bbc.co.uk/search?q=reverse mortages compulsory therapy session with a home equity conversion home loans (HECM) counselor approved by the Department of Housing and Urban Development Your house fulfills all FHA home requirements and flood requirements You continue paying all home taxes, house owners insurance and other family upkeep fees as long as you reside in the home Before releasing a reverse home mortgage, a lender will inspect your credit rating, confirm your month-to-month income versus your monthly monetary commitments and order an appraisal on your house.

Nearly all reverse mortgages are released as house equity conversion home loans (HECMs), which are guaranteed by the Federal Real Estate Administration. HECMs feature strict loaning standards and a loan limit. If you think a reverse mortgage might be right for you, discover an FHA-approved loan provider.

Are you thinking about whether a reverse home mortgage is best for you or an older homeowner you know? Prior to considering among these loans, it pays to know the truths about reverse home mortgages. A reverse mortgage, often called a House Equity Conversion Home Mortgage (HECM), is an unique type of loan for property owners aged 62 and older that lets you transform a portion of the equity in your house into cash.

The Only Guide to Reverse Mortage Tips

Getting a reverse home loan is a huge decision, because you may not have the ability to get out of this loan without selling your home to settle the debt. You likewise need to carefully consider your options to avoid consuming all the equity you have actually developed in your home.

Reverse home mortgages generally are not utilized for vacations or other "fun" things. The truth is that most borrowers utilize their loans for Great site immediate or pushing monetary requirements, such as settling their existing home loan or other debts. Or they might think about these loans to supplement their month-to-month income, so they can pay for to continue residing in their own home longer.

Securing any house loan can be expensive because of origination charges, servicing costs, and third-party closing charges such as an appraisal, title search, and tape-recording costs. You can pay for many of these costs as part of the reverse mortgage. Reverse mortgage borrowers also should pay an in advance FHA mortgage insurance premium.

What Does Reverse Mortage Tips Mean?

It also guarantees that, when the loan does become due and payable, you (or your successors) do not The original source need to pay back more than the value of the home, even if the amount due is greater than the assessed value. While the closing costs on a reverse home loan can sometimes be more than the costs of the home equity credit line (HELOC), you do not need to make regular monthly payments to the lending institution with a reverse home loan.

It's never a great idea to make a financial choice under stress. Waiting till a little concern ends up being a huge problem reduces your options. If you wait till you remain in a monetary crisis, a little extra income every month probably will not help. Reverse home loans are best used as part of a sound monetary strategy, not as a crisis management tool.

Learn if you might get approved for assistance with expenditures such as real estate tax, house energy, meals, and medications at Advantages Check Up®. Reverse home loans are best utilized as part of an overall retirement strategy, and not when there is a pending crisis. When HECMs were first used by the Department of Real Estate and Urban Advancement (HUD), a large percentage of borrowers were older ladies wanting to supplement their modest incomes.

Home Morgages Can Be Fun For Everyone

During the real estate boom, lots of older couples secured reverse home mortgages to have a fund for emergencies and additional cash to take pleasure in life. In today's economic recession, younger borrowers (often Child Boomers) are turning to these loans to handle their existing home loan or to assist pay for debt. Reverse mortgages are distinct because the age of the youngest borrower figures out how much you can borrow.

Deciding whether to get a reverse home loan is challenging. fedorarandolphwatersdykj.lowescouponn.com/10-tell-tale-signs-you-need-to-get-a-new-residential-mortages It's tough to approximate the length of time you'll remain in your home and what you'll require to live there over the long term. Federal law requires that all individuals who are thinking about a HECM reverse home mortgage get counseling by a HUD-approved counseling agency.

They will likewise discuss other options consisting of public and private advantages that can assist you stay independent longer. It's valuable to consult with a therapist prior to speaking to a lender, so you get unbiased info about the loan. http://edition.cnn.com/search/?text=reverse mortages Telephone-based therapy is available nationwide, and in person counseling is readily available in many communities.

Not known Incorrect Statements About Residential Mortages

You can also discover a therapist in your area at the HUD HECM Therapist Lineup. It is possible for reverse home loan debtors to face foreclosure if they do not pay their real estate tax or insurance, or preserve their house in great repair work. This is especially a risk for older homeowners who take the whole loan as a lump sum and invest it rapidly-- maybe as a https://www.washingtonpost.com/newssearch/?query=reverse mortages last-ditch effort to salvage a bad scenario.