An Unbiased View of Reverse Mortage Tips

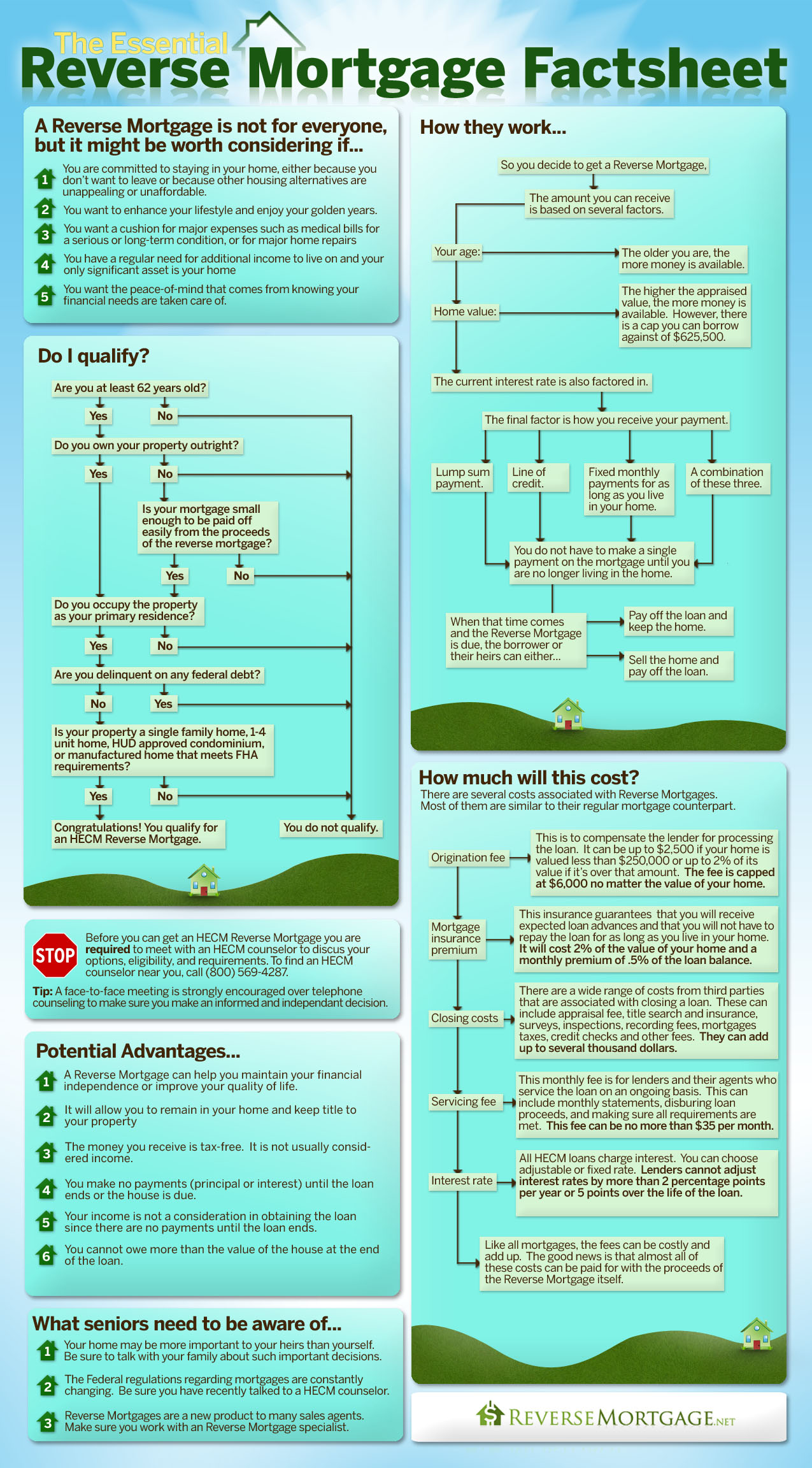

Make certain you completely comprehend the conditions of the contract prior to you sign it. By exploring all of your options, you will be better able to make the decision that finest fits you. The Financial Customer Company of Canada recommends that you ask all of these concerns before you dedicate to a reverse mortgage: What are the charges? Exist any penalties if you sell your home within a certain duration of time? If you move or pass away, just how much time will you or your estate have to pay off the balance of the loan? At your death, what occurs if it takes your estate longer than the specified time period to totally repay the loan? What occurs if the quantity of the loan winds up being higher than the value of the home when it's time https://moenuskl4r.doodlekit.com/blog/entry/6243987/15-upandcoming-mortgage-negative-convexity-bloggers-you-need-to-watch to pay the loan back? According to Canada Profits Firm (CRA), simple reverse home loan payments and lines of credit are not taxable given that they are equivalent to loan advances from a standard home loan. A reverse mortgage is a house loan that you do not have to pay back for as long as you reside in your house. It can be paid to you in one lump amount, as a routine month-to-month income, or at the times and in the quantities you want. The loan and interest are paid back just when you sell your home, completely move away, or pass away.

They are paid back in complete when the last living customer dies, offers the home, or completely moves away. Because you make no month-to-month payments, the quantity you owe grows larger in time. By law, you can never ever owe more than your home's worth at the time the loan is repaid.

If you stop working to pay these, the loan provider can utilize the loan to pay or need you to pay the loan completely. All property owners need to be at least 62 years of ages. A minimum of one owner should live in your house many of the year. Single household, one-unit house.

See This Report on Reverse Mortgage

Some condos, prepared system developments or made homes. KEEP IN MIND: Cooperatives and most mobile houses are not eligible. Reverse home loans can be paid to you: At one time in money As a month-to-month income As a line of credit that lets you choose how much you want and when In any mix of the above The quantity you get typically depends on your age, your house's worth and location, and the expense of the loan.

Many people get the most money from the Home Equity Conversion Home Mortgage (HECM), a federally guaranteed program. Loans offered by some states and local federal governments are frequently for specific functions, such as spending for home repairs or real estate tax. These are the most affordable expense reverse home loans. Loans provided by some banks and home mortgage business can be used for any function.

HECM loans are often the least pricey reverse mortgage you can get from a bank or home https://www.washingtonpost.com/newssearch/?query=reverse mortages mortgage business, and in many cases are considerably less expensive than other reverse home mortgages. Reverse home mortgages are most expensive in the early years of the loan and normally end up being less pricey over time.

Getting The Reverse Mortage Tips To Work

The federal government requires you to see a federally-approved reverse home loan therapist as part of getting a HECM reverse mortgage. To find out more about Reverse Home mortgages, visit AARP: Understanding Reverse Mortgages.

A reverse mortgage is a loan that permits you to get money from your home equity without having to offer your home. This is often called "equity release". You may have the ability to obtain up to a specific portion of the present worth of your house. The maximum quantity you will have the ability to borrow will depend on your age, your house's appraised value and your lender.

This is generally when you vacate your home, offer it or the last customer dies. You will owe more interest on a reverse mortgage the longer you go without making payments. This may lead to you having less equity in your home. To be eligible for a reverse home loan, you need to be: a house owner a minimum of 55 years old If you have a partner and you are both on the title for your house, both of you must be noted on the reverse home mortgage application.

The 7-Second Trick For Home Morgages

The home you're using to secure a reverse home mortgage must likewise be your main residence. This typically means you live in the home for at least six months a year. If you have a home loan on your home you must pay it off when you get a reverse home loan. You can utilize the money you obtain from a reverse home loan to pay any home loan, debt or lien versus your home.

Existing market trends will likewise impact how much cash you might get. Your lending institution might ask you and your spouse to show proof that you got independent legal advice prior to you get a reverse mortgage. You might have the ability to get the money from your loan by: taking the money as a one-time lump sum taking some of the money in advance and taking the rest Learn here in time Ask your lending institution what payment alternatives they provide for a reverse home loan and whether there are any constraints or costs.

You might utilize the cash you obtain from a reverse mortgage to do this. You can utilize the rest of the loan for anything you wish, such as to: pay for home repairs or improvements aid with routine bills cover healthcare expenditures pay back financial obligations You may not be http://www.thefreedictionary.com/reverse mortages able to get another loan protected by your house, such as a house equity credit line, if you have a http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/reverse mortages reverse mortgage.

Residential Mortages Things To Know Before You Get This

You have the option to pay back the principal and interest in full at any time. Nevertheless, you may be charged a fee to pay off your reverse mortgage early. Interest will be charged up until the loan is settled completely. The Check out the post right here interest will be contributed to the initial loan quantity, which increases the loan quantity over time.

You will also need to pay back the whole quantity owing if you default on the loan. You could default on a reverse mortgage by: using the money from the reverse home loan for anything that is illegal being dishonest in your reverse mortgage application letting your home fall under a state of disrepair that would lower how much it is worth not following any conditions that you accepted when getting your reverse mortgage Each reverse home mortgage loan provider might have its own meaning of defaulting on a reverse home mortgage.