Getting My Get Out Of Debt To Work

He also has a car payment and a student loan. Each time he sends his hard-earned cash out to creditors he dreams wistfully of the flexibility he 'd feel if he could at least eliminate the credit card debts. "However where do I begin?" he asks. Organize your debts Personal finance professionals have established some attempted and real debt-elimination techniques that start with a little debt analysis and house cleaning.

If you wish to slim down, you don't eat more calories, right? Exact same with losing the marilynjunevshe.theglensecret.com/getting-advice-on-deciding-upon-crucial-issues-of-debt-management debt. Put your credit cards on hiatus (and certainly do not request any new cards or loans). Use a debit card for purchases rather. This forces you to spend just the cash you actually have in the bank.

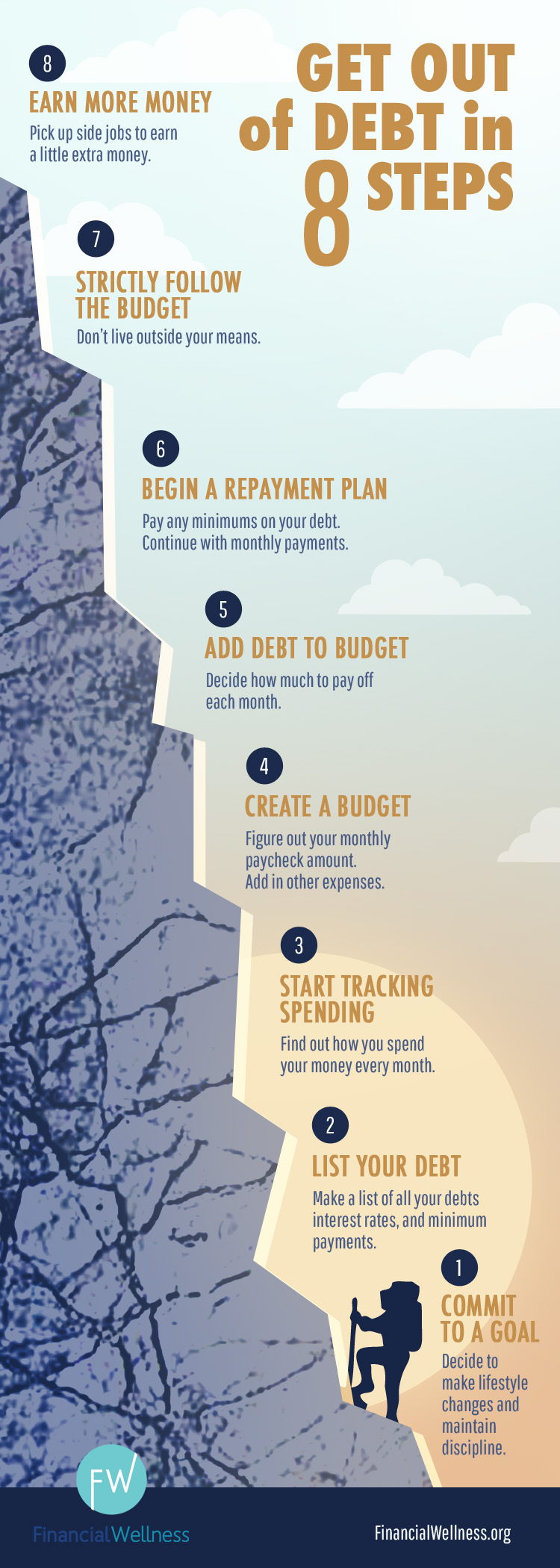

Document the balance, interest rate and minimum payment due on each account. (You don't require to consist of the primary home loan on your home unless you want to pay it off early.) Build up your minimum payments that must be made monthly, then find out just how much more you have available to help minimize the principal.

They do not help in reducing the principal which extends the regard to the loan. Concentrate on one account at a time. This is your core technique in settling financial obligations. You'll use all the cash you have beyond the minimum payment responsibilities to just one debt. Reasoning-- and mathematics-- will dictate that you concentrate on paying off the debt with the greatest rates of interest initially.

This is the quickest way to pay down debt, and it makes a lot of sense for highly motivated individuals. But if you're not in the highly inspired camp, financial expert Dave Ramsey recommends thinking of snowballs. Utilizing snowballs to pay for debts Individuals aren't always logical, and frequently motivation gets justified away.

What Does Financial Debt Solutions Mean?

Positive reinforcement really assists push you to the goal. The exact same principle applies to getting yourself out of debt and on the path to financial freedom. That's why Ramsey recommends the snowball technique . Pick your tiniest debt and pay that down first. Make just the minimum payments on your other accounts so you can use all extra funds to that tiniest debt.

Not only will you feel a sense of accomplishment when that debt is history, you'll be able to apply the minimum payment you were making on that debt, plus any additional available funds, to your next smallest debt, which you'll now concentrate on until it too is settled. By the time you get to the 3rd debt, you'll be ready with the minimum payments you were making on the very first 2 debts, plus any additional money you can spare, to make even bigger regular monthly payments and possibly accomplish an even quicker debt vanishing act.

Ramsey states that the positive support of seeing debts disappear is worth more than taking on a large, higher-interest debt with month-to-month payments that feel like they're not even making a dent. If you have two financial obligations that are basically equivalent in amount, you ought to tackle the one with the greater rate of interest initially.

Do everything possible to increase the amount you can pay towards your debt monthly by finding some extra cash: Improve your cable television package Ask lending institutions if they have reward discount rates, such as car pay Need a much better deal from your cordless supplier Compute if you Click to find out more could afford to increase some insurance coverage deductibles to assist lower premiums Offer products online Hold a lawn sale Discover ways to make some additional money Take all this extra money (" snowflakes") and apply it your existing top-priority debt.

An extra $100 or $200 a month can rapidly minimize your outstanding balance. Remember your retirement cost savings methods Monetary advisers are divided on whether it's sensible to accelerate your debt https://en.wikipedia.org/wiki/?search=debt solutions payments by cutting down on your retirement plan contributions. Some say you ought to never ever lower your retirement strategy contributions because that cash compounds tax-deferred, which is a huge advantage for long-term growth potential.

Debt Management Things To Know Before You Buy

Simply make certain you have the discipline to increase your retirement cost savings when your debt is under control. How you work your retirement cost savings into your debt pay down techniques depends upon the level of tension you're feeling about your financial obligations and the number of years you need to develop retirement earnings.

Overdue debt is an issue that just gets even worse the longer it continues. The great news is that there are ways of extricating a stack of overdue payments. Combining Loans Consolidating several loans into a single loan may reduce your general regular monthly interest, in addition to streamlining your payment process and making it easier to track just how much you owe.

Discover more at the Customer Financial Defense Bureau's website . Credit Therapy Agencies such as the National Foundation for Credit Therapy can assist you handle your debt through 4 forms of help: Evaluation your debt load and earnings Help you set up a reasonable personal spending plan Negotiate with financial institutions to reduce payments on costs Prepare for your future expenditures Your Rights Creditors do not deserve to pester you.

It forbids collectors from the following: Making use of danger of violence or other criminal means to damage a person or that individual's credibility or property Using http://edition.cnn.com/search/?text=debt solutions profane or violent language Repeated calls with intent to irritate or bug False association with the federal government, consisting of using a badge or consistent Threat of arrest Interaction at uncommon or inconvenient locations and times Communication with 3rd parties without debtor approval If you feel these regulations have actually been broken, think about filing a problem with the Consumer Financial Protection Bureau online or by calling 855-411-CFPB.

Insolvency will stay on your credit report for up to ten years, possibly affecting your ability to buy or lease a home, and will likely result in greater rate of interest on future loans. The most typical types of personal bankruptcy are Chapter 7 and Chapter 13. In a Chapter 7 or "straight personal bankruptcy" scenario, you accept turn over all your nonexempt properties to a Chapter 7 trustee, who subsequently sells your assets and disperses the cash to your financial institutions.

How Personal Debt can Save You Time, Stress, http://query.nytimes.com/search/sitesearch/?action=click&contentCollection®ion=TopBar&WT.nav=searchWidget&module=SearchSubmit&pgtype=Homepage#/debt solutions and Money.

Use our savings calculator to see how a constant technique to conserving can make your money grow. Whether saving for a house, a vehicle, or other unique purchase, the savings calculator will assist you determine the right amount to save money on a routine basis to attain your objective.

In more methods than one, debt can be a four-letter word. When it leaves control-- whether from medical costs, going shopping sprees, or unanticipated emergency situations-- it ends up being an albatross that impacts your psychological and physical health. Although it may feel overwhelming, you can deal with any debt the very same method: one action at a time.

Start by learning what debt can do to your credit score, and why charge card debt can be especially destructive. Or leap to our favorite debt reward approach, the debt avalanche . The very first thing you should understand is that debt has a ripple result throughout your entire financial life, including your credit rating .